A negative year-end result is expected for the Italian plastics and rubber processing machinery industry as reiterated in the foreign trade data just published by Istat (Italian National Statistical Institute) for January-September, analysed by the Amaplast Studies Center.

The statistics show a continuing slump in the two trade flows: -13.1% for imports (overall value of 645 million euros) and -8.5% for exports (just below 2.16 billion euros) with respect to the first nine months of 2018.

Extending our gaze to the previous quarterly results, we observe a downturn that is less accentuated for imports, which had fallen by nearly 17 points in June and 20 points in March.

Exports, on the other hand, tended to seesaw: the September results represent a new worsening with respect to the -5% in June, which had partially shored up the losses of -8% in March.

The balance of trade remains fully positive - well over 1.5 billion euros - but nevertheless has contracted by six percentage points.

The many issues and unknowns characterizing the current world economic climate, com-pounded by the announced but as yet poorly defined legislative and fiscal measures aiming at reducing the use of plastics, have begun to affect the Italian machinery manufacturers, who are expecting negative year-end results across the board.

“Speaking with my colleagues in the machinery manufacturing industry,” comments Amaplast President Dario Previero (in the picture on the right), “I note a certain amount of concern deriving from the less-than-encouraging prospects for both the domestic and foreign markets. However, we must not over-look the fact that this slump - whose first signs were seen in the year-end results for 2018 - comes after a long period of growth. With the sole exception of 2013, we have witnessed seven years with a plus sign that strengthened the industry and allowed companies to invest in research and development in order to offer their customers increasingly technologically advanced solutions.”

Previero continues: “It is no simple matter to understand whether this is a cyclical recession or a structural weakening of the sector. It is mainly the diffuse uncertainty - economic, political, commercial - that induces an increasingly marked tendency in our customers to reduce or defer investment. Of course it is true that the recent K in Düsseldorf gave us a gasp of air, but many companies complain of rather meagre results in their order books. It is thus difficult to venture a forecast for 2020, which could be a year of great volatility if the political and economic uncertain-ties that have plagued us in 2019 are not cleared up. I would also add that the theme of the circular economy was prominently featured during the German tradeshow. This great challenge could transform into significant opportunities for development for Italian manufacturers of plastics and rubber processing machinery, who are increasingly ready to market systems within an Industry 4.0 perspective, with production cycles characterized by energy savings and ability to process recycled plastics.”

Italian exports and imports

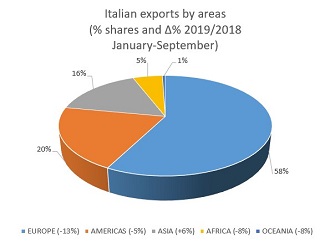

In the table and figure below, the main geographical areas and export markets for Italian plastics and rubber processing machinery are indicated.

|

Top ten destination markets for the Italian export of plastics and rubber machinery, equipment and moulds (000 euros - January-September) |

||||||

|

|

2018 |

% out of total |

|

2019 |

% out of total |

Δ% 19/18 |

|

Germany |

337,448 |

14.3 |

Germany |

270,227 |

12.5 |

-19.9 |

|

United States |

194,672 |

8.3 |

United States |

223,877 |

10.4 |

15.0 |

|

Poland |

122,072 |

5.2 |

Spain |

112,571 |

5.2 |

-3.3 |

|

Mexico |

118,768 |

5.0 |

China |

111,938 |

5.2 |

32.4 |

|

France |

117,033 |

4.9 |

Poland |

107,753 |

5.0 |

-11.7 |

|

Spain |

116,403 |

4.9 |

France |

99,888 |

4.6 |

-14.6 |

|

United Kingdom |

88,673 |

3.8 |

Mexico |

90,921 |

4.2 |

-23.4 |

|

China |

84,558 |

3.6 |

United Kingdom |

69,565 |

3.2 |

-21.5 |

|

Czech Republic |

72,235 |

3.1 |

India |

58,947 |

2.7 |

-5.7 |

|

Turkey |

69,866 |

3.0 |

Czech Republic |

55,111 |

2.6 |

-23.7 |

|

Total 'top10' |

1,321,728 |

56.1 |

Total 'top10' |

1,200,798 |

55.6 |

-8.6 |

|

Other countries |

1,036,370 |

43.9 |

Other countries |

956,551 |

44.4 |

-8.4 |

|

World |

2,358,098 |

100.0 |

World |

2,157,349 |

100.0 |

-8.5 |

Looking further down in the rankings, it is worth noting the following results regarding outlet markets that have been historically relevant for Italian plastics and rubber processing machinery manufacturers:

Looking further down in the rankings, it is worth noting the following results regarding outlet markets that have been historically relevant for Italian plastics and rubber processing machinery manufacturers:

- neighbours Austria and Switzerland registered -24% and -28%, respectively;

- the -30% for Turkey is not particularly surprising, given the country’s uncertain economic situation and the poor performance of the local converting industry, which also pushes Turkish manufacturers to concentrate more on exports. We must also keep in mind the effect of the devaluation of the Turkish lira starting in August 2018;

- Russia recorded a further slide of 19 points, following on the recently-witnessed double-digit decreases;

- Brazil showed a weak +1% after the +5% in June, which had raised hopes. Argentina is also worthy of note in the South American markets with +8%, although it represents a drop from the +18% of June;

- as regards Asia, there are clearly encouraging sales trends in two weighty markets - Thailand (+24%) and Indonesia (+39%) - while that in the equally important South Korean market has fallen by 31%;

- among the main markets on the African continent, we must distinguish between the Mediterranean countries - where only Tunisia shows positive results (+57%) as Morocco (-11%) and Algeria (-38%) fall further back - and Sub-Saharan Africa, where South Africa records a very modest +2%:

- in the Middle East, excellent results are seen in Saudi Arabia (+33%) and the Emirates (+86%), while the collapse of sales to Iran continues to represent heavy losses (-64%).

As regards imports of machinery into Italy, we observe a general decrease in purchases from European partners - for example: Germany -30%, Austria -13%, France -30%, Switzerland -35% - and a simultaneous rise in purchases from the two principal Asian suppliers - China +14% and Japan +33%.

Registration for Plast 2021 is open

Registration opened on November 12, 2019, for the upcoming edition of Plast-International Exhibition for Plastics and Rubber Industries. Organized by Promaplast, the Amaplast operations company, the fair will take place in Milan from Tuesday the 4th to Friday the 7th of May 2021.

Organization of the principal European tradeshow for the sector in 2021 is thus in full swing. Together with the four concomitant exhibitions in The Innovation Alliance (Ipack-Ima, Meat-TECH, Print4All, and Intralogistica Italia), it will compose the year’s most important event dedicated to the capital machinery market.

Those registering by the early deadline (February 10, 2020) are entitled to a 20% discount on the admission fee and will also benefit from priority stand assignment.